SPEAK WITH A FINANCIAL ADVISOR TODAY | CALL (623) 974-0300

Using Life Insurance to Fund your Retirement

Life insurance can be leveraged to mitigate investment risk and can provide multiple tax-efficient strategies for your retirement plan.

Before we breakdown life insurance as an asset class, let's review some key terms you should know:

- Death Benefit - The amount paid to beneficiaries when a policyholder dies.

- Beneficiary - The person(s) who are selected by the policyholder to receive the death benefit.

- Premium - The regular payments made toward the insurance policy. Typically made monthly.

- Cash Value - A tax-deferred savings account that is included in permanent life insurance policies.

What are the different types of life insurance?

Term Life Insurance

Term life (also known as pure life insurance), is a type of insurance that lasts a certain number of years, then ends. The term depends on what you choose when you take out your policy, but common terms are 10, 20, or 30 years.

If you die during the term of the policy, the insurer will pay the face value of the policy to your beneficiaries. The cash benefit, which in most cases is tax-free, can be used for after death expenses such as funeral costs, mortgage debt, car debt, and so on.

If the policy expires before your death, then there will be no payout. At your policy's expiration date, you may be able to renew your term policy, but keep in mind your premium could be higher, since it's typically recalculated based on your age and the time of renewal.

Term life insurance policies have no cash surrender value. This means that if you decide to give up your coverage to the insurer, you won't receive anything in return.

Whole Life Insurance

Whole life insurance provides death benefit coverage for the duration of the insured's lifetime. In addition to a death benefit, whole life insurance can also contain a cash value, which accumulates on a tax-advantaged basis throughout the duration of the policy.

Although this form of life insurance is more expensive than term, it covers you for your entire life. The savings component (cash value) of your policy can be invested, meaning that the policyholder has the access to the cash while alive. Most whole life insurance policies have a withdrawal clause. If you have had your whole life insurance coverage for long enough, you may be able to receive some of the cash value of the policy upon surrender.

Universal Life Insurance

A universal life insurance policy can allow you to vary the amount and timing of when you pay premiums and may also permit you to change the amount of the subsequent death benefit. Indexed Universal Life insurance (IUL) offers many of the same benefits as traditional universal life insurance, with one primary difference: the way interest is credited to the cash value of the policy. IUL interest is credited to the cash value based on the movement of a specific stock market index or indexes over a specific period of time, within the parameters of a cap and a floor without directly participating in the market.

Variable Universal Life Insurance

A variable universal life (VUL) policy includes an investment feature, which means the cash value of the policy will fluctuate based on the investment performance of a separate account that offers a variety of investment options. Life insurance policies may be subject to restrictions, limitations and early withdrawal fees or surrender charges. VUL insurance policies typically have both a maximum and minimum floor on the investment, as well as a built-in savings component. Exposure to the market and its volatility can offer significant returns, but also increase the exposure to risk. Policyholders should carefully assess their level of risk before purchasing a VUL Insurance policy.

What are the Tax Advantages of Life Insurance?

Depending on your retirement goals, there can be a variety of ways to hedge your tax impact. What makes life insurance such a unique asset class, is that not only can it be a supplemental solution to address your financial concerns, but it also offers a variety of tax advantages, as well as distribution and transfer capabilities.

Tax Advantage #1 - Tax Free Benefit:

Thanks to IRC Section 101(a), beneficiaries of an individually owned life insurance policy generally do not have to pay income taxes on the death benefit. That said, there are instances in which your policy could be taxable. If you plan to earn interest on the policy, or if your life insurance is part of a large estate, it might be worthwhile to talk to a financial professional.

Tax Advantage #2 - Tax-Deferred Accumulation Potential:

Any cash value growth in a life insurance policy is tax-deferred. While inside the policy, the owner is not subject to income taxes on the cash accumulation.

Tax Advantage #3 - Tax-Free Distributions:

Money borrowed or taken from the cash value of the policy are not subject to income taxes up to the "cost basis"-- the amount you put into the policy through paid premiums.

Tax Advantage #4 -Tax-Free Accelerated Death Benefits:

If the insured becomes terminally or chronically ill, a portion of the death benefit, "the living benefit," may be paid out while the insured is still alive. These tax-free benefits are paid on a per diem (or other period basis), and are excluded from income tax up to a certain limit determined by the IRS, per

IRS Section 7702B(b).

How can I diversify my tax exposure?

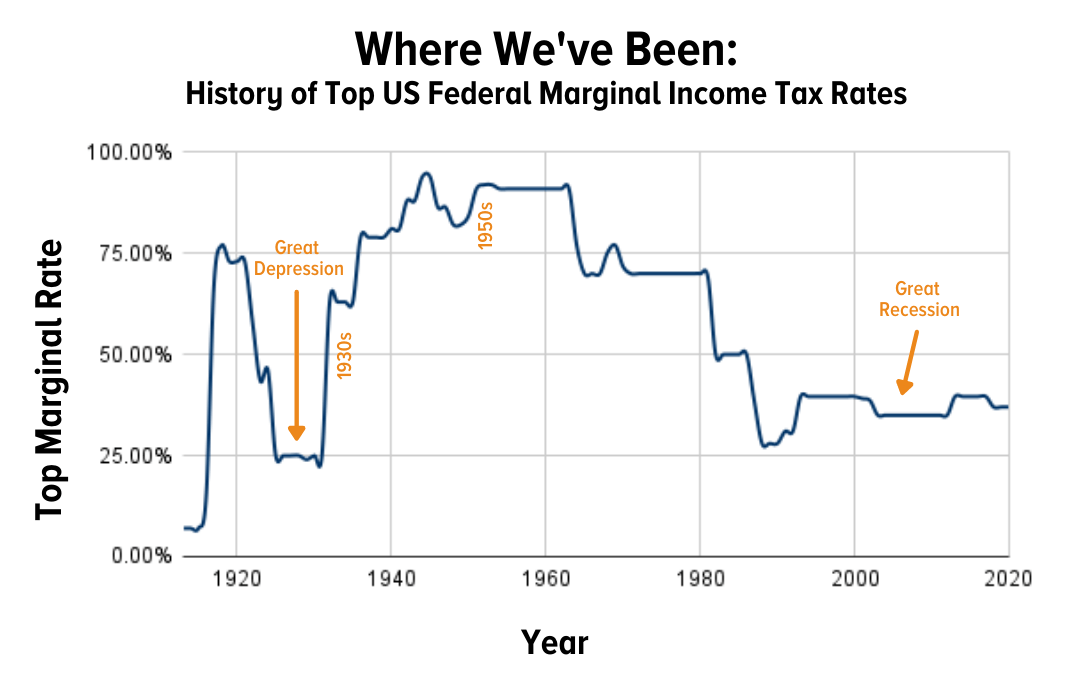

When it comes to the economy, it's safe to say our past informs our present. Throughout history, U.S. income tax rates have increased in response to events both here in the United States and around the world.

Where are we today? Well, our government has a large amount of debt on their hands… in fact, it’s

roughly $28.53 Trillion.

Compared to the decades-long era of high tax rates (averaging over 60% and topping at 90%), we are at a major discount right now.

If you're looking to limit your chances of getting hit with higher taxes in the future, life insurance could be a potential way to diversify your portfolio.

In general, the more taxes you pay in retirement, the more income you'll need to generate in order to not only pay those taxes, but to also still live comfortably.

Things to Consider:

- The costs of a life insurance policy (both your premiums and insurance charges) is dependent on your health and age at the time of the application.

- Most life insurance policies require health, and in some cases, financial underwriting.

- Most life insurance policies include surrender charges.

- Consult with your financial and tax advisor to help determine what strategies are appropriate for your specific situation.

Work with an Advisor Today

At Fullerton Financial Planning, our goal is to help you enjoy your retirement with confidence, not worrying about whether or not you have enough money to enjoy it. The last thing anyone wants is unexpected taxes when they begin to withdraw from their retirement accounts.

There’s never a bad time to start planning for retirement. If you’re starting early or if you feel you’re way behind, or if you don’t know where to start, we’re here to help wherever you’re at in the process. Sit down with a Fullerton Financial Advisor today and find out how you can get on track with your retirement goals.

Ready to Get Started?

Let's Meet!

For more information about any of our Phoenix products and services, schedule a meeting today.

CORPORATE OFFICE

14155 N. 83rd Ave., Suite 144

Peoria, AZ 85381

Phone: (623) 974-0300

Fax: (623) 974-0330

All Rights Reserved | Fullerton Financial Planning

Built by REV77