SPEAK WITH A FINANCIAL ADVISOR TODAY | CALL (623) 974-0300

Three Pillars of a Successful Retirement

The retirement planners at Fullerton Financial Planning believe there are three separate pillars that are vital to a stable, long-lasting retirement plan. These three pillars are:

- Income

- Market readiness

- Taxes

If you have a solid strategy in place for each pillar, your retirement plan is more likely to be stable and capable of weathering uncertain economic times or market volatility. However, if just one of those pillars is compromised or absent, you may run into problems.

Inadequate income in retirement can force retirees to accept a lower standard of living or even return to the workforce. A retirement plan that doesn’t account for market risks may be poorly diversified and vulnerable to volatility or downturns. Failure to develop an asset-protecting tax strategy could result in a surviving spouse being short on funds or families failing to receive the assets you intended to bequeath.

The worst-case scenarios can often be avoided, even if you’re behind on retirement savings, if you have an appropriate strategy for each of the three pillars.

You can determine the condition of your pillars by completing our checklist. Be honest with yourself when reviewing each section. If you discover one or two of your pillars might not be as stable as you initially assumed, one of our retirement planners is available to help.

The First Pillar: A Holistic Income Strategy

This pillar is all about ascertaining:

- What you’ve saved up to this point

- Your projected monthly and annual budget

- How much supplemental income you expect to receive in retirement

- An estimate of the extra expenses you’ll incur each year (medical costs, gifts, home repairs, etc.)

Calculating an estimate of your income and expenses will enable you to better gauge your financial preparedness for reaching your goals and managing the unexpected. For example, a retired couple might need a total of up to $295,000 to cover healthcare costs after the age of 65.

We can also help you adjust for inflation. The $100,000 a year you need to cover your expenses in 2022 might be closer to $200,000 by 2042.

Our retirement planners can assist with strategizing benefit usage. Some retirees may be best served by receiving Social Security benefits as soon as possible and accepting the reduced rate while others could be better off waiting for the full amount at a later age.

The Second Pillar: Market Readiness

Assessing your retirement saving strategy’s market readiness requires a thorough and honest assessment of your risk tolerance and approach to investing. It’s also important to recognize early on that your investment strategy will likely need to be adjusted as your retirement progresses to ensure you don’t run out of money in your later years.

One of the biggest risks, and an unfortunate outcome many current retirees are experiencing, is being forced to withdraw significant funds after a portfolio has decreased in value due to market forces beyond your control.

Drawing down your investment accounts when markets are in a trough can have serious ramifications years in the future. There are ways to adjust your plan to prevent the necessity of those scenarios, but it requires planning.

We can help ensure you have a flexible plan that allows your strategy to change depending on market conditions.

The Third Pillar: Forward-Thinking Tax Strategy

Has your tax strategy been updated since the 2017 Tax Cuts and Jobs Act or the 2019 SECURE Act? Do you have a plan in place to adjust your tax strategy after some of those new rules expire?

The goal of our tax strategy assessment is to help retirement savers understand the moving parts in their tax strategy and learn how they may need to adjust it as tax laws change. You may also need to alter your tax strategy if your preferences or retirement goals change as you age.

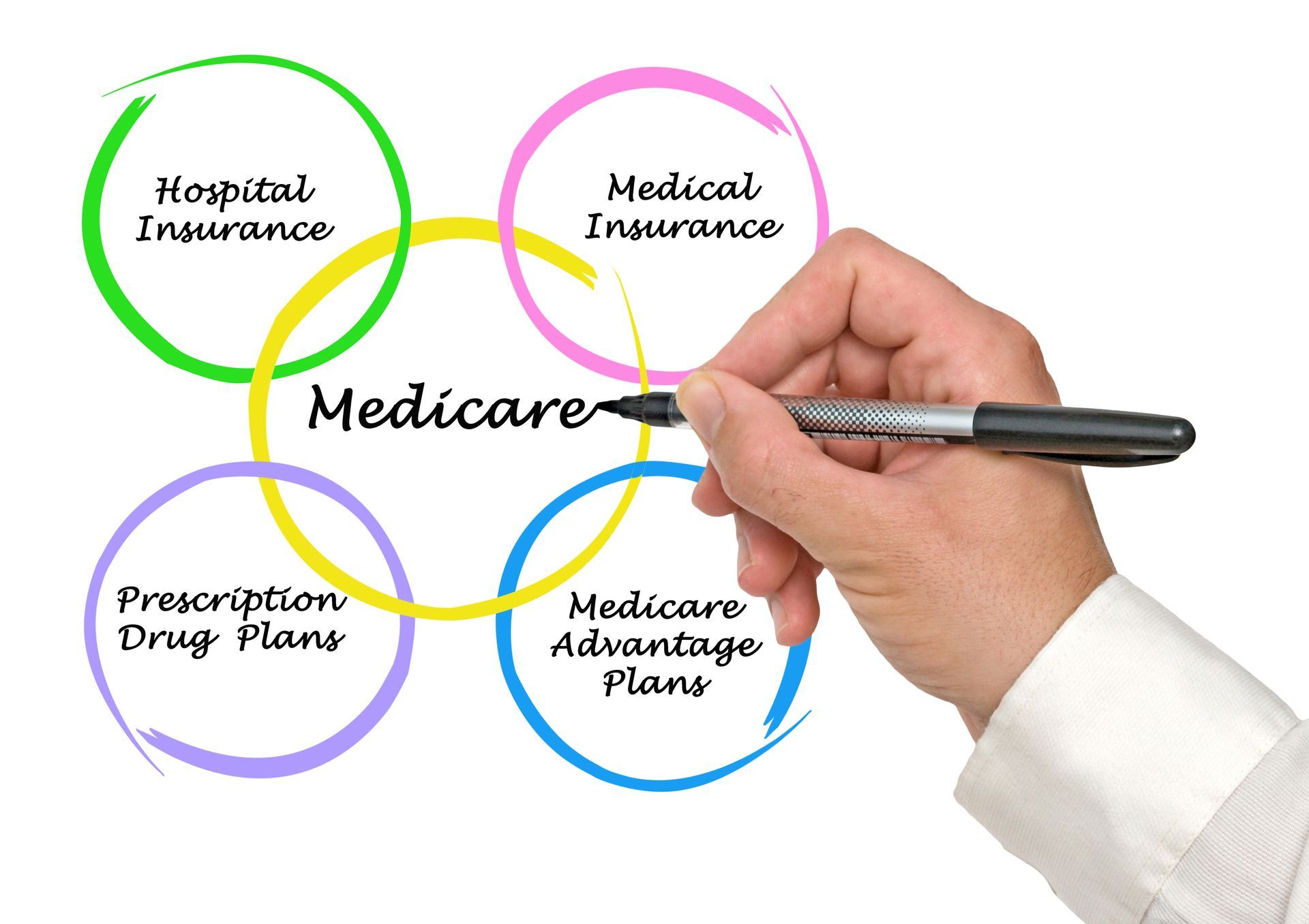

We can help you understand the intricacies of taxable, tax-deferred and tax-free wealth categorizations, and how you can maximize your after-tax income. Our retirement planners also work with younger savers on developing plans to cope with the potential future instability of Social Security and Medicare.

Not every retiree has the desire to stay constantly apprised of changing tax laws and rules. Our team is here to ensure you maintain a forward-thinking tax strategy, even as the financial landscape changes.

Stabilize Your Retirement Planning Pillars

It’s important for every current worker (regardless of age) and retiree to understand and optimize their three pillars, but it’s especially vital for savers who are within five years of their target retirement date. This is the period where you have the opportunity to make up for past mistakes or lock in a strategy that will finance your ideal standard of living for the rest of your life.

Our retirement planners are here to help you assess your three pillars and develop effective strategies for maintaining predictable financial stability in retirement. Call us at (623) 974-0300 to speak with a retirement planner today.

Ready to Get Started?

Let's Meet!

For more information about any of our Phoenix products and services, schedule a meeting today.

CORPORATE OFFICE

14155 N. 83rd Ave., Suite 144

Peoria, AZ 85381

Phone: (623) 974-0300

Fax: (623) 974-0330

All Rights Reserved | Fullerton Financial Planning

Built by REV77