Planning for a successful and fulfilling retirement isn’t easy. In addition to establishing predictable and adequate income for the next several decades, you also need an estate plan, a reliable health care plan, including long-term care and nursing policies, and a tax strategy. We encourage planners to complete the checklist challenge to identify weaknesses in their retirement plan.

What Is the Source of Your Retirement Income?

Knowing where your income is coming from isn’t enough. It’s a good idea for retirees, especially young ones, to take a long view. Plan as if your income will need to last into your 90s and be sure to adjust it for inflation. Consider Social Security’s impact on your income and how that will impact your taxes. If you’re receiving a pension, make sure you understand all its intricacies and the rules on spousal benefits. Those factors may help you decide the ideal time begin receiving your benefits and at what level.

Are Your Inventories up to Date?

It’s important to know the value of your assets and household liabilities. Many people go into retirement with a significant amount of debt. Those liabilities may consist of:

- Mortgages

- HELOCs or second mortgages

- Credit card debt

- Medical debt

- Personal loans

- Auto loans

A Complicated Web of Savings

It’s not uncommon for modern retirees and retirement savers to have several retirement savings accounts (401(k)s from different jobs, traditional and Roth IRAs, CDs, savings accounts, brokerage accounts, etc.) They might also have commercial or rental properties and vacation properties in addition to their primary home.

It’s important to know what and where these assets are and accurately ascertain their market valuation when you’re finalizing your retirement plan.

Although working can be a drag, there are some unique perks income from employment provides – like regular cost-of-living adjustments. Retirees relying on their own savings may be forced to go several more decades without ever receiving a raise. A long-term fixed income can present some serious challenges, especially when you get into your second or third decade of retirement.

The team at Fullerton Financial Planning can help you create an accurate inventory, so you have an precise picture of your financial situation.

Manage Risk

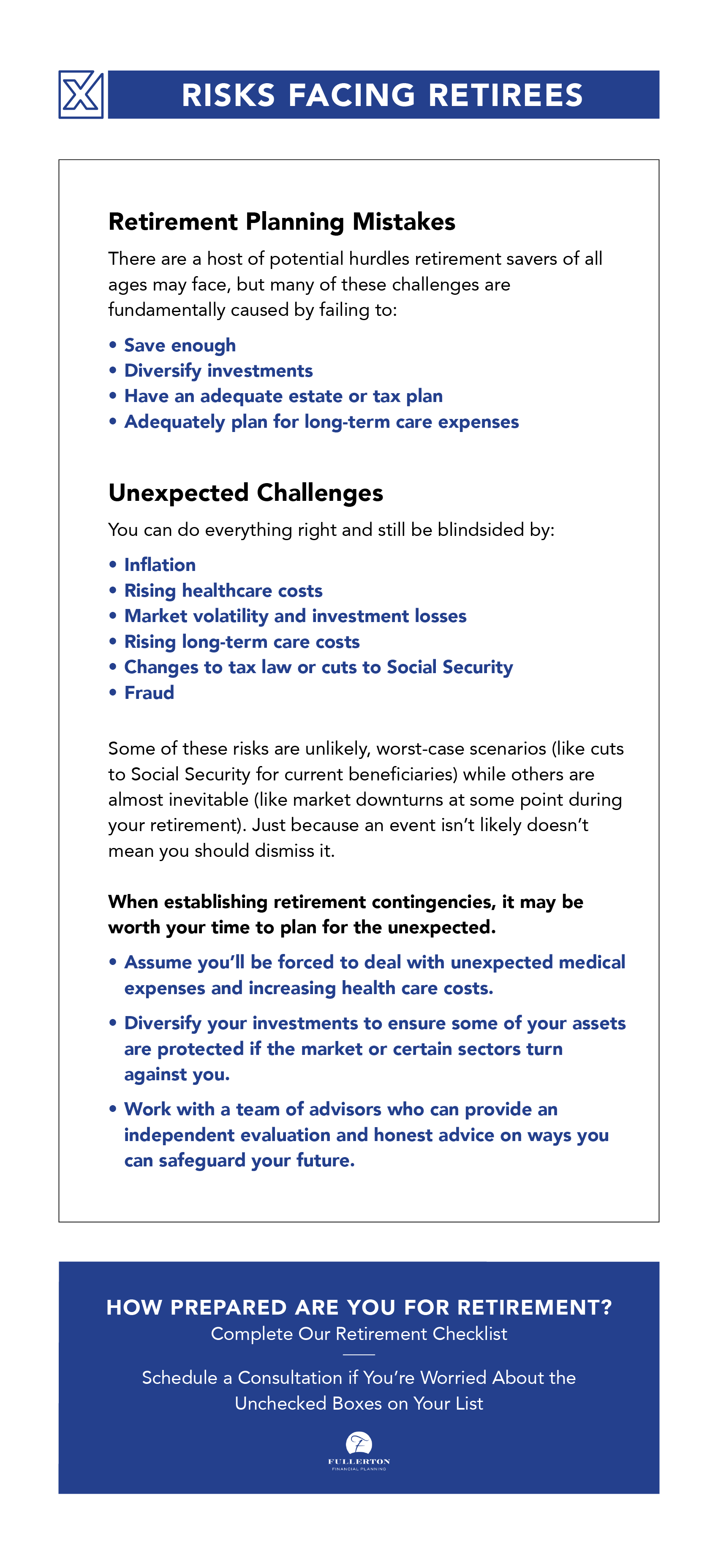

Does your retirement plan have the flexibility to accommodate both predictable challenges and unexpected life events? Even retirees who have adequate retirement income and savings might be at a significant disadvantage when certain scenarios arise. You might have plenty of supplemental income from rental properties today when you retire, but what about 20 or 30 years from now if housing inventories overcorrect and the market is more advantageous for renters?

A lack of diversification, relying too much on high-risk investment strategies or failing to plan for long-term nursing care can make life difficult for retirees that don’t have contingencies.

Better risk management is one of the main benefits of getting a second opinion from a third-party financial advisor. A retirement planning professional who optimizes retirement plans for a living can identify risks or potential weaknesses in your retirement plan and suggest solutions.

Current and Future Tax Obligations

A whole host of products are marketed as paying for themselves. Window installers, HVAC companies and many other home service providers often tell potential customers that, “These things pay for themselves in the long run.” Whether those claims are true or not often depends on a variety of factors, like how long you will live in the home and the other features of your home that contribute to efficiency or energy savings. In a lot of cases, it’s a great sales talking point but not necessarily accurate.

Working with an experienced CPA who knows tax planning inside and out can be a different story. They can help retirees with required minimum distribution (RMD) planning to minimize their taxes on these distributions. They’re able to help some retirees convert large quantities of taxable income into tax-free retirement income (cash value life insurance, Roth IRAs, HSAs, municipal bonds, etc.) or structure their income and assets to keep them in a lower tax bracket.

Those types of services often do pay for themselves many times over. Although working with a CPA isn’t free up front, it may end up offering a much better ROI than you’ll get from high-priced replacement windows.

What’s Your Checklist Challenge Score?

Workers in the Valley who are currently planning for retirement and those that are looking for better ways to save should contact the team at Fullerton Financial Planning. We encourage you to take our survey and consider the potential weak points in your retirement plan. Our financial advisors can help you fill in any blanks and optimize your retirement plan. Call us at (623) 974-0300 to speak with a financial advisor.